Let’s talk about how ransomware is destroying businesses today.

- Since 2019, ransomware attacks have risen about 232%

- Cases of Ransomware increased 13% this last year alone.

Do we have your attention?

The average American business is under attack, and few people are talking about it. With cybersecurity threatening to wipe out small-to-medium-sized businesses with limited security measures, cyber liability insurance is becoming harder and harder to obtain.

The Importance of Cyber Liability Insurance

The value of proper cyber liability insurance cannot be understated. The benefits are far-reaching, and they themselves could fill an entire article alone. Let’s take a look at a few of them:

- Protection from fines, legal fees, and settlements

- Avoiding costs of repairing the damage caused by a cyber attack

- Prevention of lost income due to downtime or reputation loss

Why is Cyber Liability Insurance So Hard to Acquire?

Insurance companies are aware of the rise in cyber attacks, and as a result, many now require detailed risk assessments, security measures, and compliance certifications before they will offer coverage.

Insurance providers want to know that businesses have taken appropriate steps to protect themselves from data breaches and other cyber-related disasters. Unfortunately, many small businesses don’t qualify for cyber liability insurance because they lack the resources to do this on their own. This is where ThrottleNet comes in.

How Can ThrottleNet Help?

With the complications surrounding cyber liability insurance, and now with the understanding that your business needs to invest in it, you need a partner by your side to help you through the process. ThrottleNet is that partner.

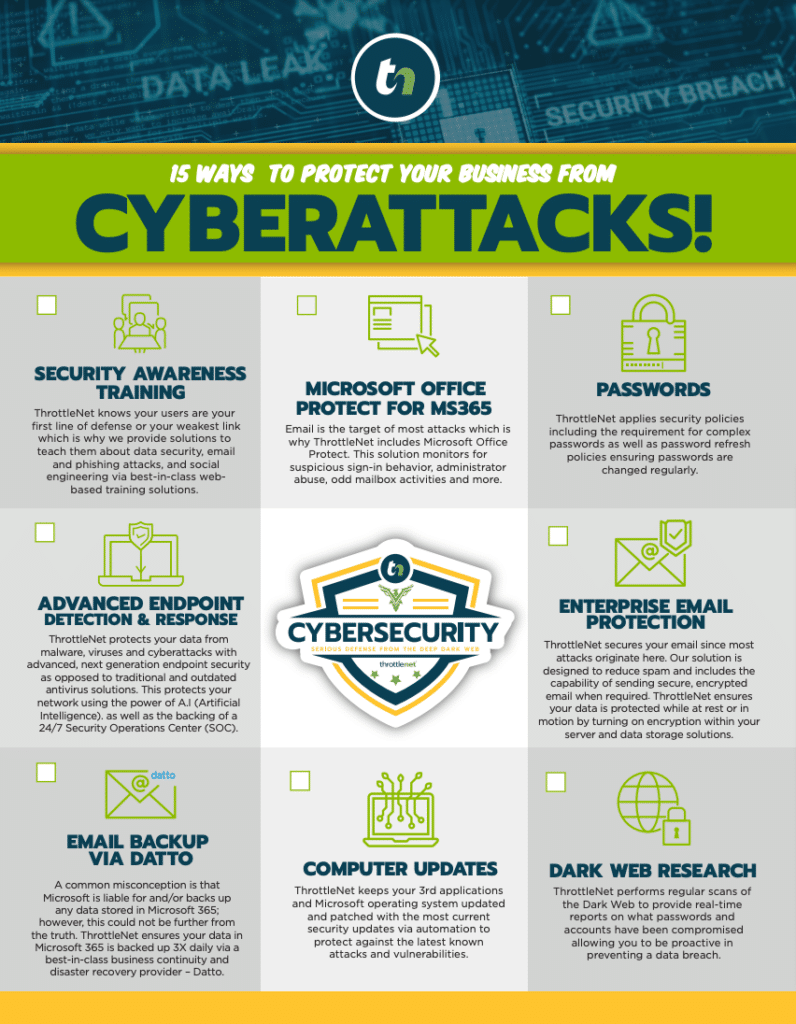

What We Can Do for You:

- Check off the boxes: When you’re trying to run a business, manage employees, and take care of customers, the last thing you want to worry about is the extensive application process that most liability insurance companies require. ThrottleNet can help you check off all the boxes to ensure you get the lowest possible premiums, and that you get paid out in the event of an attack.

- We can fill out the application: One of the more complicated and time-consuming tasks when applying for liability insurance is filling out the application. Our team can help fill out the application, which in itself is extremely confusing and difficult for those unfamiliar with cybersecurity.

- Lower your risk and premiums: With the Managed Cybersecurity and Cyber Protection program, ThrottleNet can help you lower your risk, which in return lowers your premium. If you do get hacked, the cyber protection program helps pay the claim so that you can recover from a breach quickly.

Managed Cybersecurity and Cyber Protection program

Are you confident in your organization’s security measures? Do you have a cyber protection plan already in place? If not, ThrottleNet can assist with both.

With an experienced team of professionals and robust technology solutions, we can help lower your risk, which in return lowers your premium. And as mentioned before, if you do get hacked, our cyber protection program helps pay the claim so that you’re not stuck footing the bill alone.

ThrottleNet: Your Partner for Cyber Liability Insurance

Don’t let ransomware ruin your business. Get ahead of the problem and contact ThrottleNet today to learn more about our Managed Cybersecurity and Cyber Protection program. Let us help you get the coverage you need to protect your business in the event of a cyber attack.

Contact ThrottleNet today and take control of your cyber liability insurance process!