Being hacked can be a very traumatizing experience. And when your sensitive customer data has been compromised, it can be even more overwhelming. 70% of Americans fear that in today’s digital climate, their data isn’t as well-protected as it was just five years ago. You may feel like you are not in control of the situation, and that can be very stressful.

When your accounting firm has been hacked, it is important not to panic. There are steps you can take to begin the recovery process and regain your customers’ trust. And if you have a cybersecurity disaster recovery plan established, putting that plan into practice will mitigate the damage done and get your firm back on its feet.

With these stressful situations, the ideal scenario is to prevent them from happening in the first place. By working with an IT service provider who can develop a cybersecurity disaster recovery plan for your company, you can be better protected from these attacks.

Why Do Hackers Target Accounting Firms?

Hackers target accounting firms because they are a valuable source of information. During 2020 alone, there were six times as many losses that occurred from cyberattacks than in previous years. Sensitive customer data, such as social security numbers and credit card numbers, can be used to commit identity theft or fraud.

There are several warning signs that your firm may have been hacked, including:

- An increase in spam emails

- Unexplained changes to website content

- Problems with website functionality

- Unusual activity on social media accounts

If you notice any of these red flags, you should take action immediately so that if you have undergone a data breach, the issue doesn’t become worse. The sooner you can identify the problem, the easier it will be to resolve.

What To Do if Your Company Data is on the Dark Web?

As a business owner, the thought of your sensitive customer data being stolen and sold on the dark web is undoubtedly frightening. It’s becoming increasingly common for hackers to target companies of all sizes and steal their data. And once that data is out there, it’s nearly impossible to get back.

If your firm’s data is breached, you’ll want to quickly respond to the situation:

1. Inform your customers of the breach and provide them with information on how they can protect themselves from identity theft or fraud.

2. Change your passwords and update your security measures.

3. Consult with a cyber security specialist to help you secure your systems and prevent future attacks.

4. Implement a plan to monitor your systems for any unusual activity.

5. Keep an open dialogue with your customers so that they feel comfortable entrusting their information to you in the future.

A data breach can be a nightmare for any business owner, but by following these steps, you can begin to recover from the attack and take appropriate measures to prevent an attack from happening in the future.

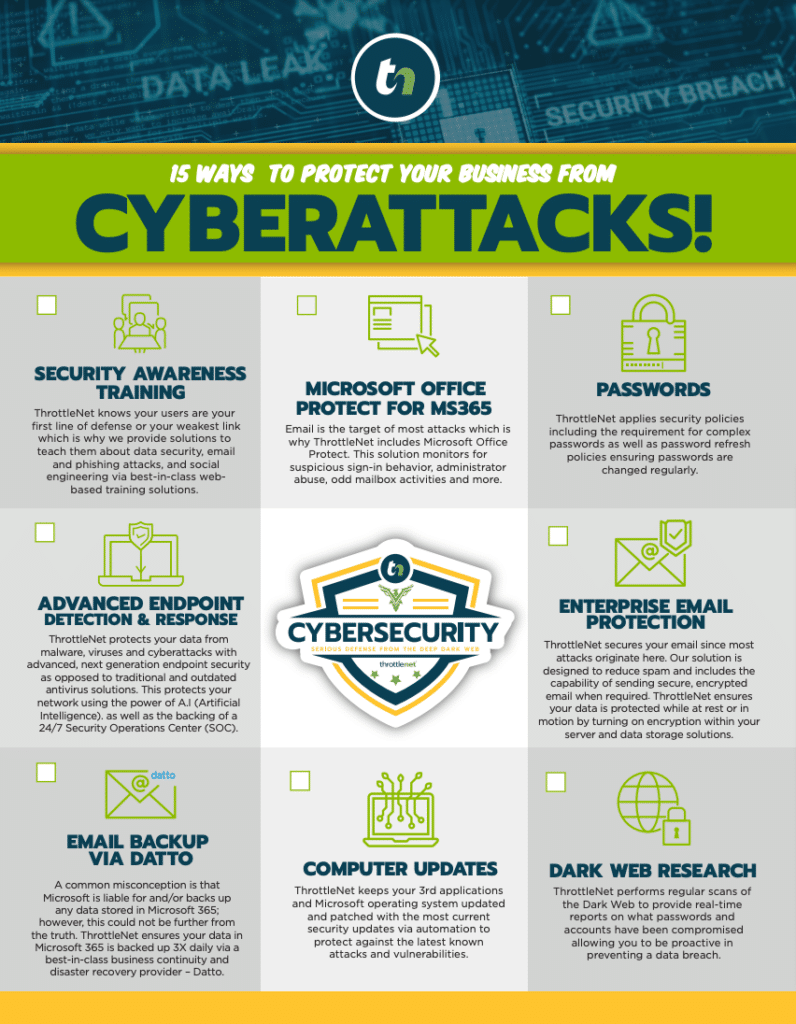

Working with ThrottleNet helps prevent a breach from happening by helping your company build a robust cybersecurity structure. If an issue were to occur, their cybersecurity protection plan protects your firm up to $500,000, and they will help you create a cybersecurity disaster recovery plan that will reduce the damage.

Accounting Firms Need Robust Prevention Tactics

The best way to deal with a data breach is to prevent it from happening in the first place. By having a robust cybersecurity plan in place, you can protect your firm from these attacks. And if an issue does occur, having a disaster recovery plan in place will help mitigate the damage.

Partner with ThrottleNet to ensure that your company’s customer data and sensitive information stays protected. Contact us today!